|

When I first relocated to the US with my job 3 years ago, I remember being provided with a 47-page new hire benefits book during the orientation, and was immediately overwhelmed by all the new information I had to digest within a short period of time. The benefits book included information about all different types of insurance plans, savings plans, and a bunch of other benefits. It was also filled with jargon like High Deductible, HSA, FSA, 401(k), Short-term disability, etc. In Malaysia, retirement savings are done through Employee Provident Fund (EPF), a government-managed retirement savings scheme. The EPF requires mandatory monthly contributions by both the employee (11%) and employer (12% or 13%) directly through automatic salary deduction. I was a total stranger to the 401(k) retirement savings plan, and I have to make my own contribution investment elections?? My oh my... I admit, I wasn't very worldly in this aspect. All the different medical, dental, and vision plans were also new to me as I was used to going to panel clinics (for free), and getting reimbursed by my company for any dental or vision expenses up to a certain amount. Now that I've finally figured all these out (thanks to hubby and Mad Fientist), it really isn't all that complicated. Well, I take that back. I'm still discovering new information as I work through this post. The length of this post implies the complicated-ness. Looking back, it was indeed overwhelming having to make all my enrollments and elections within a month. Heck I was also dealing with getting social security, setting up bank account, taking driving tests, etc. during my first month here!

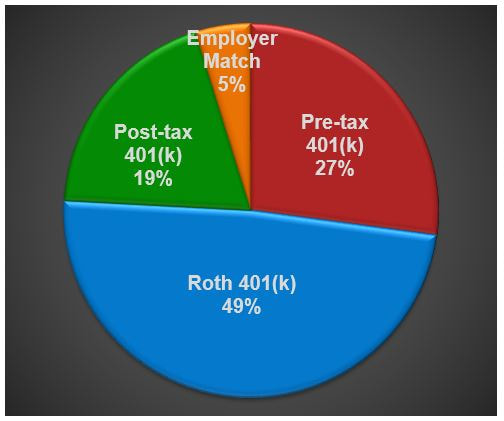

Summary of each retirement savings account (assuming withdrawal after 59 ½) For the purpose of this post, I'll focus on the various types of savings/investment vehicles we use: 401(k) Contributions There are 3 different types of 401(k) contribution, and we had/have all 3 types: 1. Pre-tax/Traditional 401(k)

2. Roth 401(k)

(ii) All employer match and the related earnings were rolled into a Traditional IRA 3. Post-tax/After tax 401(k)

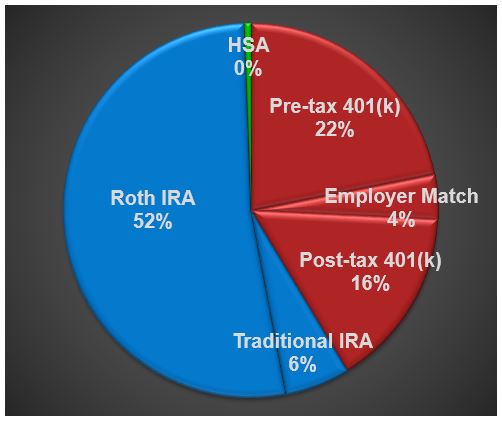

Individual Retirement Account (IRA) Contributions There are 2 types of IRA contribution, Traditional IRA and Roth IRA. 1. Traditional IRA

2. Roth IRA

HSA Contributions

Taxable Accounts

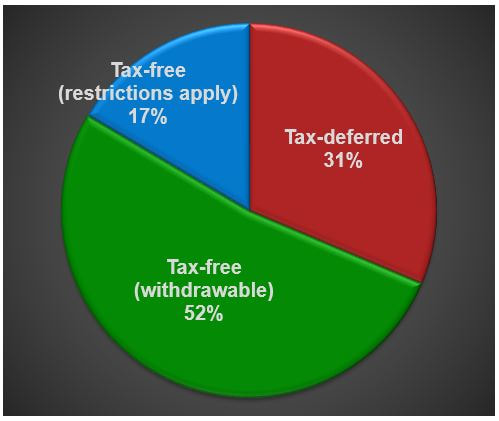

That's all the savings/investments vehicles we currently have (and plan to have) in the US. Based on the current tax rules (who knows when it will change again), these are the rollover options and potential withdrawal strategies we can use in the future.

More on ways to access retirement funds early --> Another good one from Mad Fientist Lastly, my bonus two-cents for aspiring early 'retirees':

2 Comments

Thanks Zack! We worked through our numbers to find out approximately how much we'll need for 20 years before we reach 59.5 and these Roth contribution turned out to be a pretty good option to have in our portfolio (especially since he didn't have the post-tax 401k at work). Our tax-free (withdrawable) balances plus a modest amount of Roth conversion could last us till we get to withdraw the earnings penalty free at 59.5!

Reply

Leave a Reply. |

Categories

All

ArchivesMay 2021 January 2021 November 2020 August 2020 June 2020 May 2020 April 2020 March 2020 December 2019 August 2019 July 2019 May 2019 December 2018 October 2018 September 2018 August 2018 July 2018 June 2018 May 2018 March 2018 February 2018 December 2017 November 2017 October 2017 September 2017 August 2017

|

RSS Feed

RSS Feed