Tax optimization

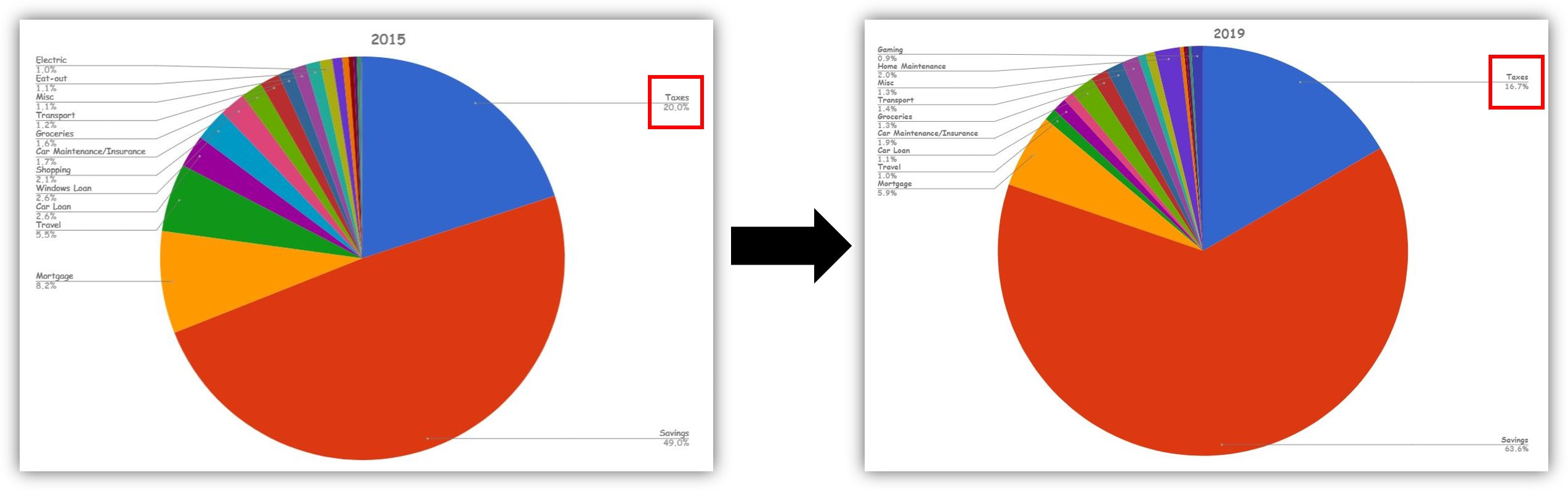

I am a CPA, but my job does not involve any tax preparation or tax filing. However, I'm interested to learn about optimizing our taxes, because reducing taxes means increasing the amount we can save and invest. In 2019, 16.7% of our pre-tax income went to taxes, which includes Federal tax, State tax, Social Security tax, Medicare tax. As a comparison, our effective tax rate was 20% in 2015. Even though our total income has increased over the years, we've been able to reduce the % of taxes we paid by using several tax optimization strategies.