|

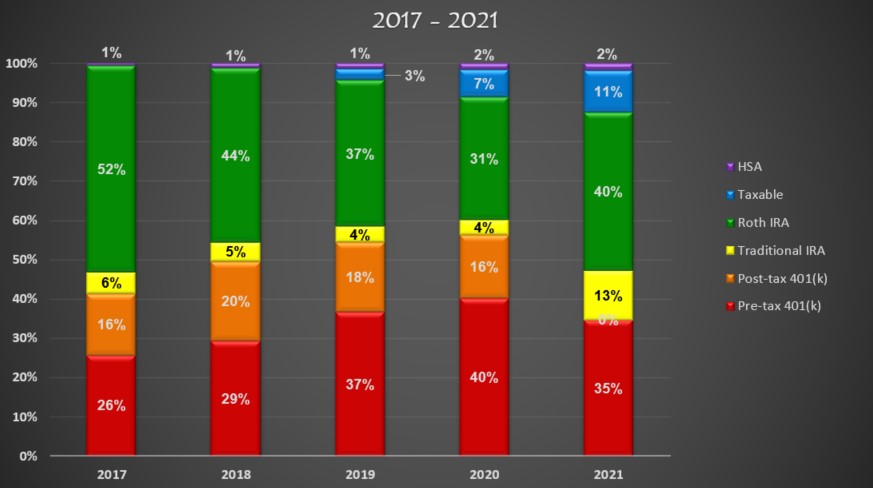

Breakdown of our investment portfolio from 2017 - 2021 As a follow up on this post from 2018, it's time to revisit how our retirement savings strategy is going and review the breakdown of our investment portfolio. We're still in the accumulation phase and our savings/investments are pretty much on auto-pilot mode, with focus on maximizing all tax-advantaged accounts first. While we're nowhere near the withdrawal phase yet, it's important to do a periodic check to make sure our investment portfolio is 'well-balanced' for future withdrawals. As mentioned above, we try to maximize all tax-advantaged accounts first (for the tax benefits), which explains why the Pre-tax 401(k) bucket has been growing. I'm also including all gains for my Post-tax 401(k) within the Pre-tax 401(k) bucket as they are still subject to taxes in the future. We've been able to max out all tax-advantaged buckets in 2021, so any surplus has been going into the taxable bucket.

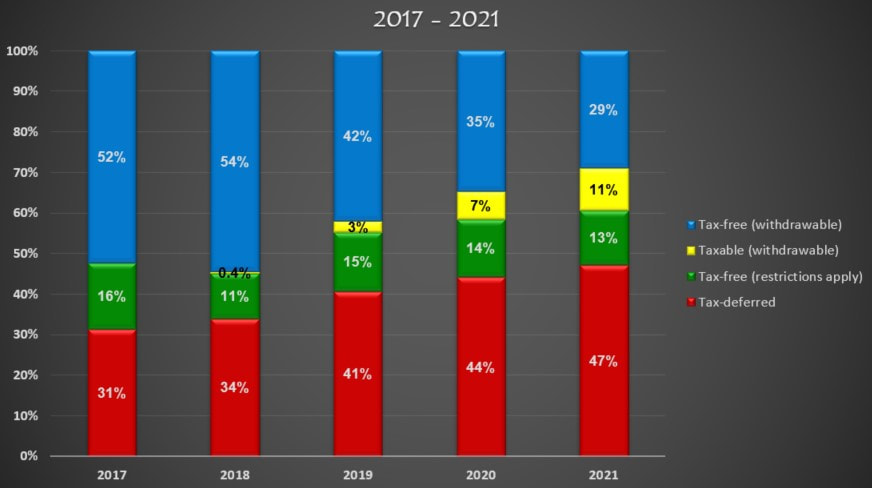

The numbers above are maximum contributions allowed for each tax-advantaged accounts. Just to clarify, these are NOT our numbers. =P (*Did not max out) Breakdown of our investment portfolio based on tax implications on withdrawal Even though our tax-deferred bucket is growing larger (thanks to bull market), we're still diversified enough to have a pretty even split between our tax-free and tax-deferred bucket. The following is how we 'bucketed' each account based on the tax implications:

Tax-free (withdrawable): Post-tax 401k contributions, Roth IRA contributions Taxable (withdrawable): Brokerage account Tax-free (restrictions apply): Roth IRA earnings, HSA Tax-deferred: Pre-tax 401k contributions (including employer contributions) and earnings, Post-tax 401k earnings, Traditional IRA contributions and earnings The tentative withdrawal strategy will be based on the following sequence: Taxable (withdrawable) → Tax-free (withdrawable) → Tax-free (restrictions apply) → Tax-deferred I fully acknowledge the 'nerdiness' of this post. To be honest, it's really more for my own reference purposes. Refer to this post for more details on what all the different types of account represents.

0 Comments

Leave a Reply. |

Categories

All

ArchivesMay 2021 January 2021 November 2020 August 2020 June 2020 May 2020 April 2020 March 2020 December 2019 August 2019 July 2019 May 2019 December 2018 October 2018 September 2018 August 2018 July 2018 June 2018 May 2018 March 2018 February 2018 December 2017 November 2017 October 2017 September 2017 August 2017

|

RSS Feed

RSS Feed