|

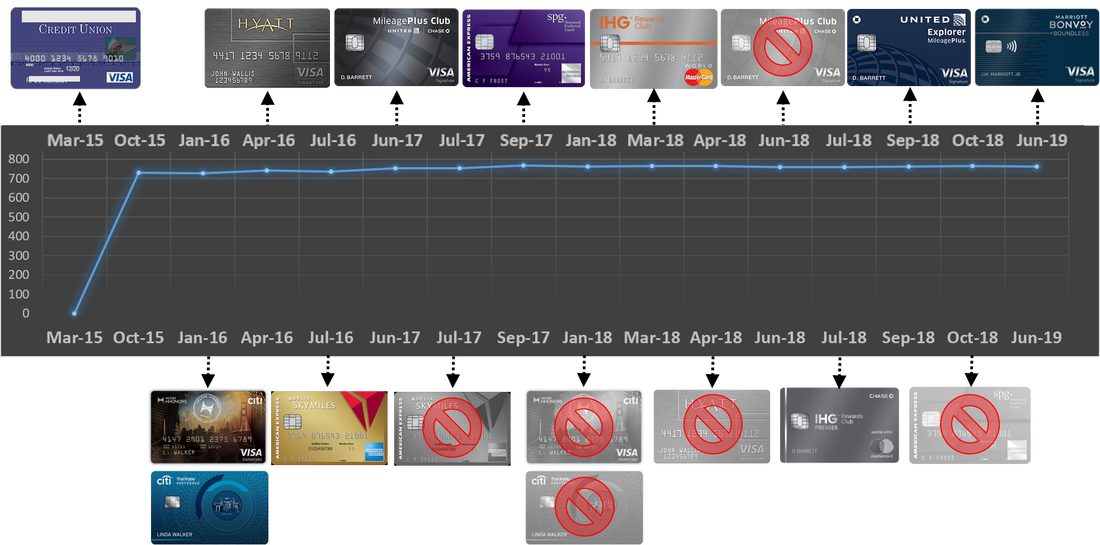

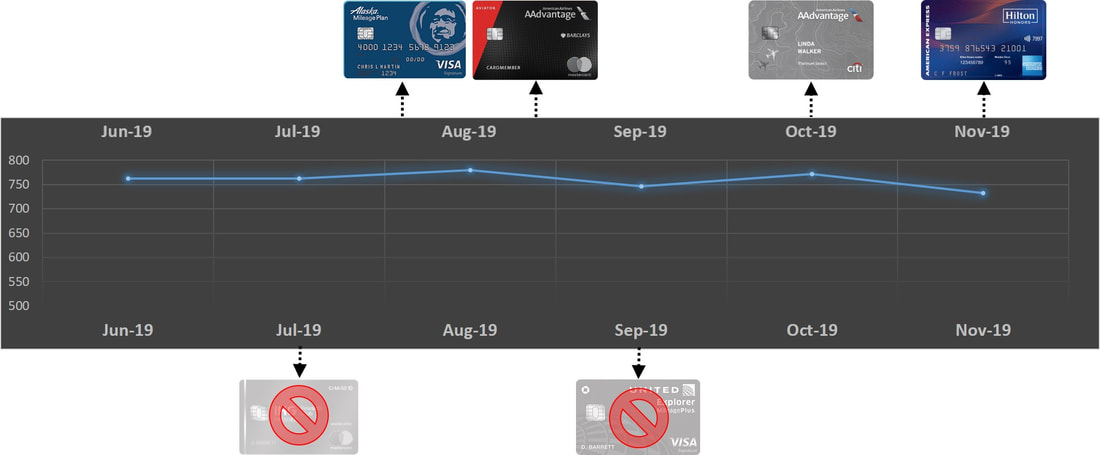

Original post: 5/20/2018 Updated: 12/20/2019 For someone who enjoys traveling, the lucrative credit card sign-up bonuses in the US are amazing, especially when all you get for opening a credit card in Malaysia is a luggage bag. I was hoping to start building our credit card portfolio as soon as I moved to the US, however, I realized very quickly (when my Chase Freedom application was declined) that I wasn't gonna get approved for any credit cards without credit history. Myth: Opening multiple credit cards will hurt your credit score. My credit score (Equifax, Experian, and TransUnion) has consistently hovered around the mid 700s despite all the activities. It took me a year to build my credit score from scratch and since then, I've added (and removed) a few credit cards in my purse and have gotten some values out of them. Thanks to credit card rewards, we've traveled to Cancun, Guatemala, Cape Town, etc. for almost free. If there are no changes to our plan, we will also be traveling to Iceland, Fiji, and New Zealand this year using credit card rewards. Before I go down the list of all the credit cards I've had or still have, I'd like to clarify that we ALWAYS pay off our credit cards in full before the due date, and we DO NOT carry any credit card balance. For us, credit card is just a form of payment and a tool that allow us to travel cheaply, not a source of cash flow (even though our credit limits are pretty high). The following is a list of my credit card portfolio, and the respective sign-up bonuses I received. Note: Some offers are no longer available. 1. xxx Credit Union Credit Card

Sign-up bonus: None Min spend: None Annual fee: None 2. Citi HiltonHonors Visa Signature

Sign-up bonus: 40,000 Hilton points Min spend: $1,000 within first 3 months Annual fee: None 3. Citi ThankYou Preferred

Sign-up bonus: 15,000 ThankYou points Min spend: $1,000 within first 3 months Annual fee: None 4. Chase Hyatt

Sign-up bonus: 2 free nights Min spend: $1,000 within first 3 months Annual fee: $75 (1st year waived) 5. Amex Delta Skymiles Gold

Sign-up bonus: 50,000 Delta Skymiles and $50 statement credit for Delta purchase within 3 months Min spend: $1,000 within first 3 months Annual fee: $95 (1st year waived) 6. Chase MileagePlus Club Card

Sign-up bonus: United Club Membership ($550 value) and other travel benefits Min spend: None Annual fee: $450 (1st year waived) 7. AMEX Starwood

Sign-up bonus: 30,000 Starpoints Min spend: $3,000 within first 3 months Annual fee: $95 (1st year waived) 10. Chase United MileagePlus Explorer 12. Bank of America Alaska Airlines Visa Signature

Sign-up bonus: 40,000 Alaska Mileage Plan Miles + $100 statement credit Min spend: $2,000 within first 3 months Annual fee: $75 13. Barclays AAdvantage Aviator Red World Elite Mastercard

Sign-up bonus: 60,000 American AAdvantage Miles Min spend: $1 within first 3 months Annual fee: $99 14. Citi AAdvantage Platinum Select World Mastercard

Sign-up bonus: 60,000 American AAdvantage Miles Min spend: $3,000 within first 3 months Annual fee: $99 (1st year waived) 15. Hilton Honors Aspire Amex

Sign-up bonus: 150,000 Hilton points (unfortunately I wasn't eligible for the sign-up bonus) Min spend: $4,000 within first 3 months Annual fee: $450 (1st year waived) And of course, I can't leave hubby out of this 'game'. These are the cards he had/has in his wallet: I don't disagree that travel hacking with credit cards can be confusing, and I've made my fair share of mistakes. I've also spent a lot of time reading various resources (e.g. The Points Guy, Travel is Free, etc) to learn and find the best available credit card deals that suit our needs. It can be frustrating trying to keep up with all the changes (and devaluation) but the benefits definitely outweigh the efforts. Here's a quick summary of how we keep up with the Card-ashians. =P What's our card opening strategy? ChooseFI has a good post on the Chase Gauntlet, but the strategy is not for us because Southwest doesn't fly from our home airport and I currently prefer international travels over domestic travels. Our strategy is to apply for credit cards based on our specific travel plans and needs, or to take advantage of lucrative offers before they discontinue. We also diversify the various points and miles we earn. If you haven't noticed, I've been inclined towards cards without annual fees or with fees waived for the first year. Even for those with annual fees, they were offset by statement credits. How does frugal people like us meet the minimum spend? Apart from mortgage, car loan, and utility bills, we pretty much put every expenses on our credit cards. Even so, we barely spend anywhere close to $3,000 within 3 months. Besides, we don't do any manufactured spend, so we rely solely on our organic spending (i.e. we don't intentionally spend more just to meet the minimum spend). We time our credit card application when we have big expenses coming up (e.g. we applied for the Chase Sapphire Preferred and SPG Amex when we had to spend $8K to replace our HVAC system). I also intentionally look for cards with lower minimum spend of $1-2K, which are more manageable. Do we keep all these cards opened? Answer is, mostly not. We keep most of our cards open for about a year and either cancel or downgrade them before the annual fee kicks in. That means I do need to keep track of all the minimum spend, when we opened/closed a card, and track if we are over or under the 5/24 limit. And yes, I do have a spreadsheet to keep track of all these (I have a spreadsheet for everything...lol!). =P Are you leaving money on the table? In the past, I've always wondered why aren't there more people taking advantage of these amazing credit card perks in the US and I've also tried introducing them to friends and family. However, I've learnt that not everybody has the patience and willingness to explore the rabbit hole of travel hacking. I also wouldn't encourage anyone who can't pay off their credit cards in full every month to get into any of these. For those who are interested to learn more, there are plenty of resources and information online. I'm also happy to share what I know to those who are willing to learn more. =)

3 Comments

Ashley

6/19/2018 07:08:14 pm

Would you be willing to explain how you are using credit card rewards to travel to New Zealand? I am also interested in traveling there in the next couple of years. I thought I heard you mention on the ChooseFI podcast that you are using Alaska miles for that, but the Alaska Airlines website does not show that they fly to New Zealand.

Reply

Hey Ashley,

Reply

Ashley

6/19/2018 09:17:39 pm

Wow, thanks for your extremely detailed response! This will help me out immensely! Leave a Reply. |

Categories

All

ArchivesMay 2021 January 2021 November 2020 August 2020 June 2020 May 2020 April 2020 March 2020 December 2019 August 2019 July 2019 May 2019 December 2018 October 2018 September 2018 August 2018 July 2018 June 2018 May 2018 March 2018 February 2018 December 2017 November 2017 October 2017 September 2017 August 2017

|

RSS Feed

RSS Feed